Tax Residency for 90 days only in the territory of Kazakhstan

No CFC rules;

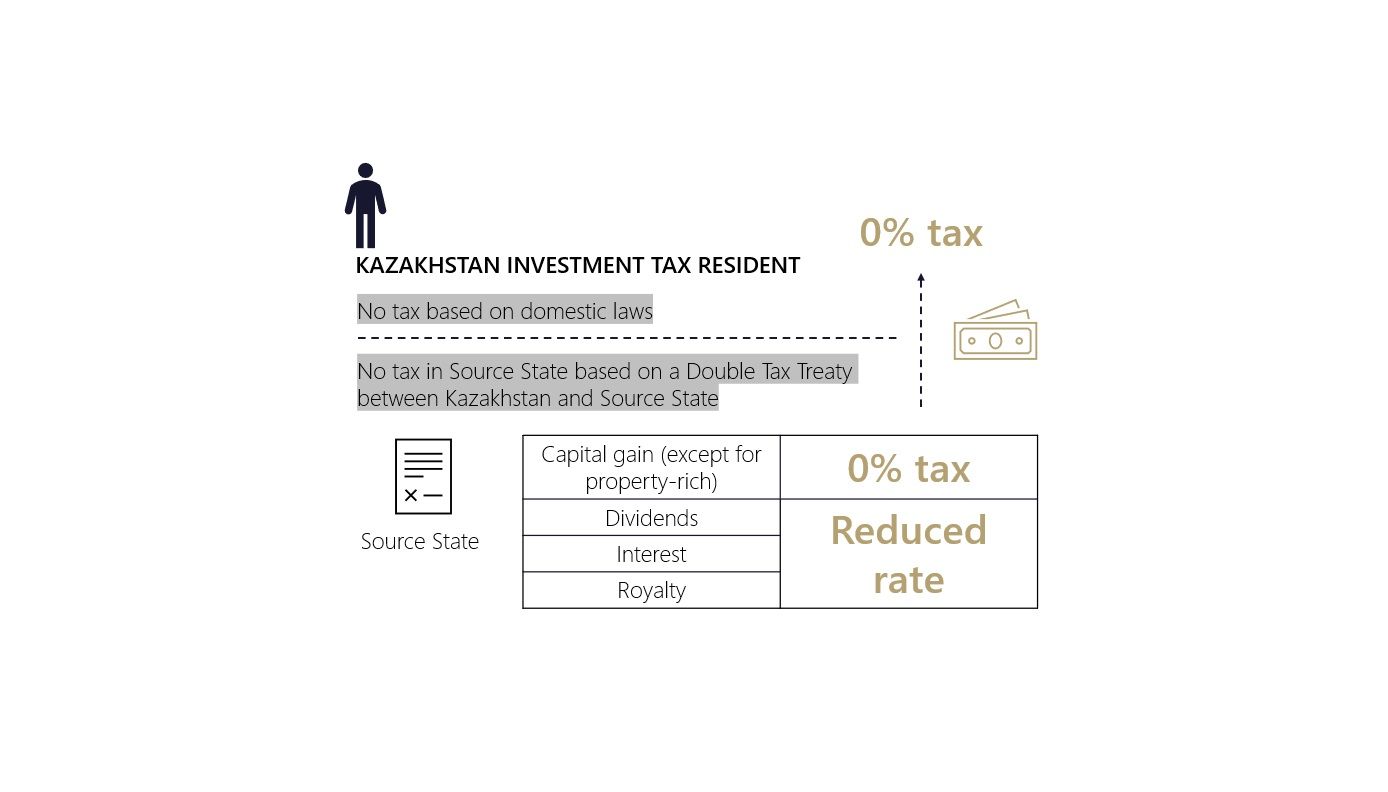

100% foreign-sourced income exemption

MLI: Simplified Double Tax Treaty Benefits Test for Individuals (when being an individual is enough to enjoy DTT benefits)

USD 60k+ investments in traded securities (Astana International Exchange)

The investments are refundable!

Appr. USD 50k non-refundable fee for issuance of Tax Residency Certificate

USD 7 750 administrative fee

Loose other country tax residency

All non-Kazakhstan income is exempted till 2066

We are among very few law firms which have practical experience supporting HNWI clients in obtaining status of Kazakhstan Investment Tax Resident:

The programme is fairly young (since 2022);

Kazakhstan Government is not focused on worldwide promotion of the programme

Contact us for details.:

Alexander Nepomnyashchiy

T: +7 903 248-00-82 (WhatsApp)

E: avn@lawfirmemet.com

Evgeny Pankratov

T: +7 926 472-20-13 (WhatsApp)

E: pe@lawfirmemet.com